Rising home prices have been in the news a lot lately and much of the focus has been on whether home prices are accelerating too quickly, as well as how sustainable the growth in prices really is. One of the often-overlooked benefits of rising prices, however, is the impact that they have on a homeowner’s equity position.

Home equity is defined as the difference between the home’s fair market value and the outstanding balance of all liens (loans) on the property. While homeowners pay down their mortgages, the amount of equity they have in their homes climbs each time the value of their homes go up!

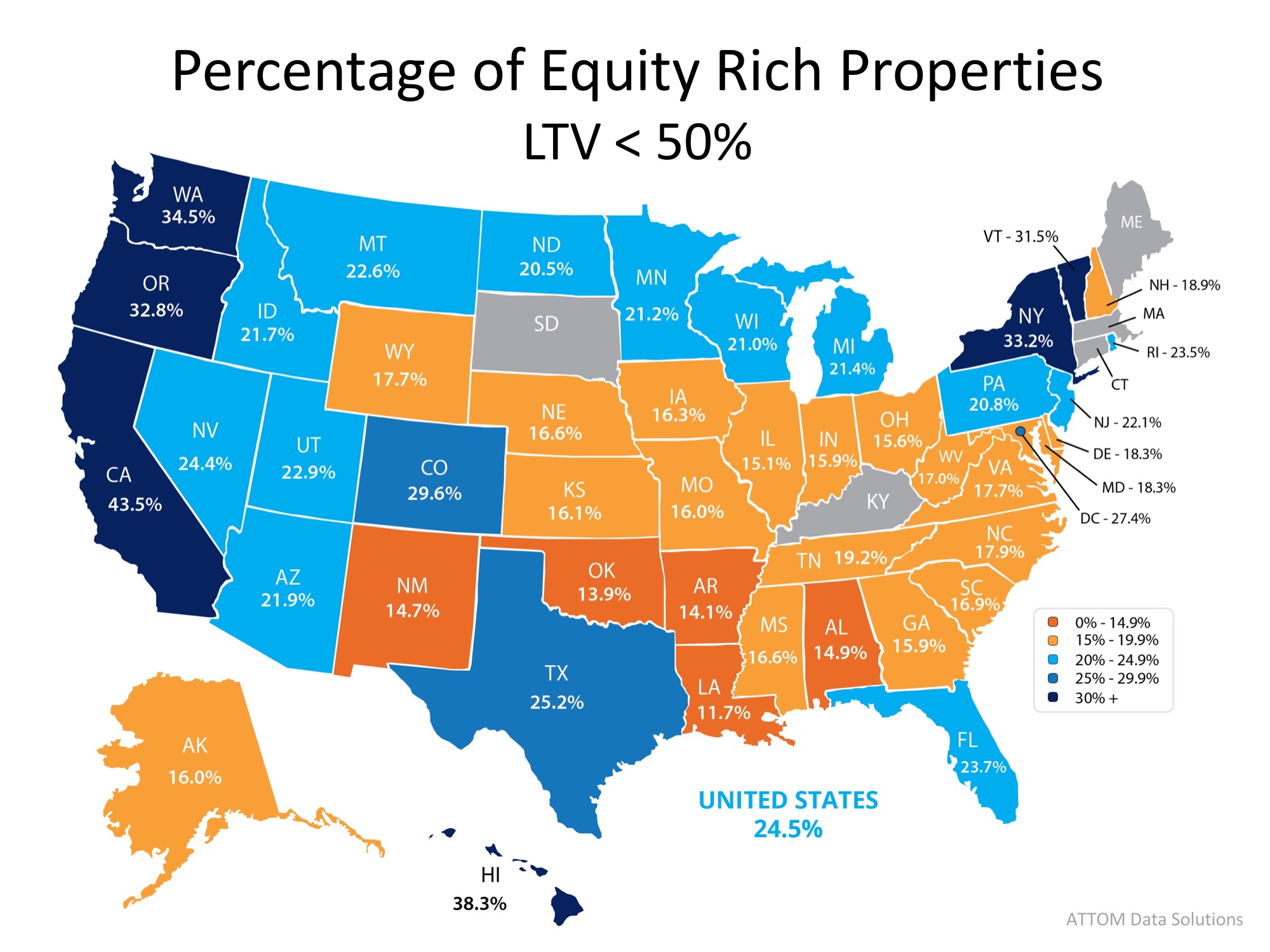

According to the latest Equity Report from ATTOM Data Solutions, “13.9 million U.S. properties in Q2 2018 were equity rich — where the combined estimated balance of loans secured by the property was 50 percent or less of the property’s estimated market value — representing 24.9% of all U.S. properties with a mortgage.”

This means that nearly a quarter of Americans who have a mortgage would be able to sell their homes and have a significant down payment toward their next home. Many who sell could also use their new-found equity to pay off high-interest credit cards or help children with tuition costs.

The map below shows the percentage of properties with a mortgage in each state that were equity rich in Q2 2018.

And so here's the Bottom Line...

If you are a homeowner looking to take advantage of your home equity by moving up to your dream home, let’s get together to discuss your options!

For More Information about today's real estate market, please feel free to contact me:

(435) 640-1488

Katrina@KatrinaAuthement.com

www.KatrinaAuthement.com or www.LiveTheParkCityLife.com

Free Real Estate Mobile App: Text Utahhomes103 to 32323

Free Home Valuation: www.KatrinasUtahHomeValues.com